Client demands are higher than ever before in today’s insurance industry. Policyholders anticipate quick reaction times, effective claim servicing, and tailored service, while agents continuously must balance leads, follow-ups, compliance, renewals, and more. Relying on spreadsheets or legacy systems typically leads to lost opportunities, poor client relationships, and reduced sales growth.

This is where Customer Relationship Management (CRM) comes into play. An insurance agent’s CRM not only organizes leads and policies but also reminds them automatically, tracks client interactions, and ensures that each policyholder gets timely service.

In this blog, we are going to tell you why CRM matters in insurance and examine the top 5 CRM software for insurance agents in 2025 so you can make the most well-informed choice for your agency.

What is an Insurance Agent CRM?

A CRM (Customer Relationship Management) system is a software that enables agents and agencies to organize their clients, policies, and interactions in one place. While universal CRMs offer the standard features, insurance-specific CRMs include industry-specific features such as policy tracking, claim management, renewal reminders, commission tracking, and compliance tools. For insurance agents, a CRM is more than a database, it acts as a partner that automates repetitive tasks and streamlines daily work.

Quick Link: Best CRM for Startups (Complete Guide 2025)

Key Benefits of CRM for Insurance Agents

No longer an option for insurance agents who want to stay ahead, here are the main benefits:

- Lead Management: Monitor prospects, segment them, and automatically follow up so no lead gets away.

- Policy Tracking: Save information of every policyholder, including renewals and claims, in a single secure repository.

- Automation: Send reminders for renewals, claims notifications, and cross-sell triggers.

- Data Insights: Get insights into sales performance, customer behavior, and revenue growth.

- Compliance Support: Save secure records for audits and compliance with industry regulations.

- Enhanced Customer Experience: Personalized interactions create stronger trust and higher retention.

The 5 Best CRMs for Insurance Agents in 2025

Following are the 5 best CRMs suitable for insurance agents this year. Each is outlined in one detailed paragraph, covering features, price details, and best suitability.

1. HubSpot CRM

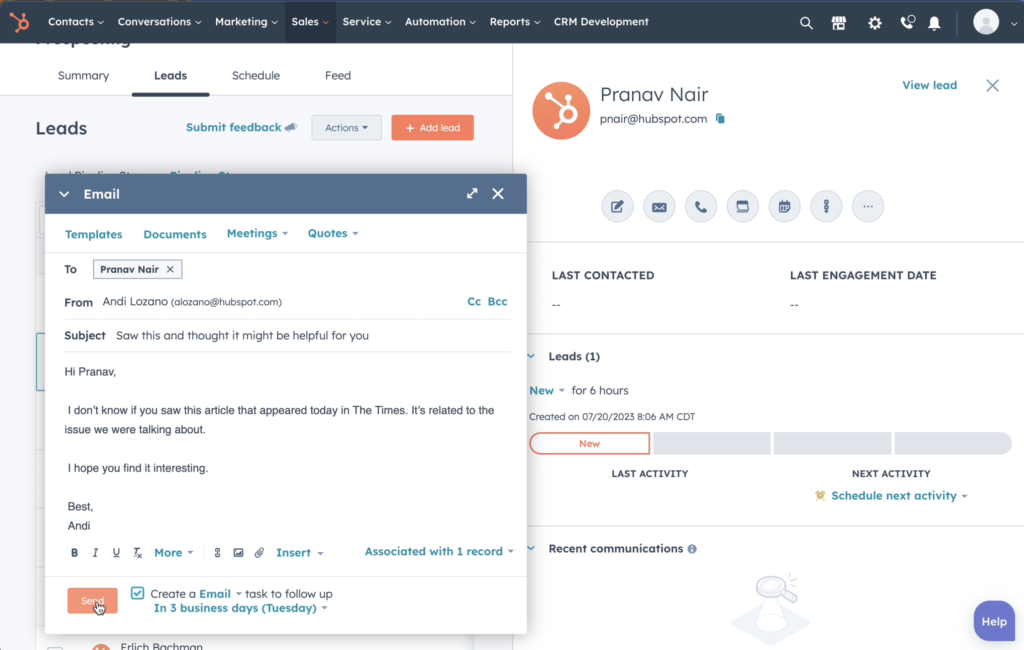

HubSpot CRM is one of the most popular CRMs used by insurance agents because it is easy to use and offers powerful automation features. It allows agents to save an unlimited number of contacts for free, hence acting as a decent starting point for small agencies or single agents. With functionality like deal pipelines, email tracking, scheduling meetings, and automated marketing, HubSpot helps agents automate communication and lead nurturing efficiently. Its integration with various apps, including call tools and signature tools, makes it flexible to use in agencies managing multiple clients daily. For agencies looking to scale, HubSpot offers high-end paid plans with analytics backed by AI and custom workflows, which will enable agencies to scale without platform-altering. Ideal for agents who require a user-friendly, scalable, and current CRM.

2. Zoho CRM

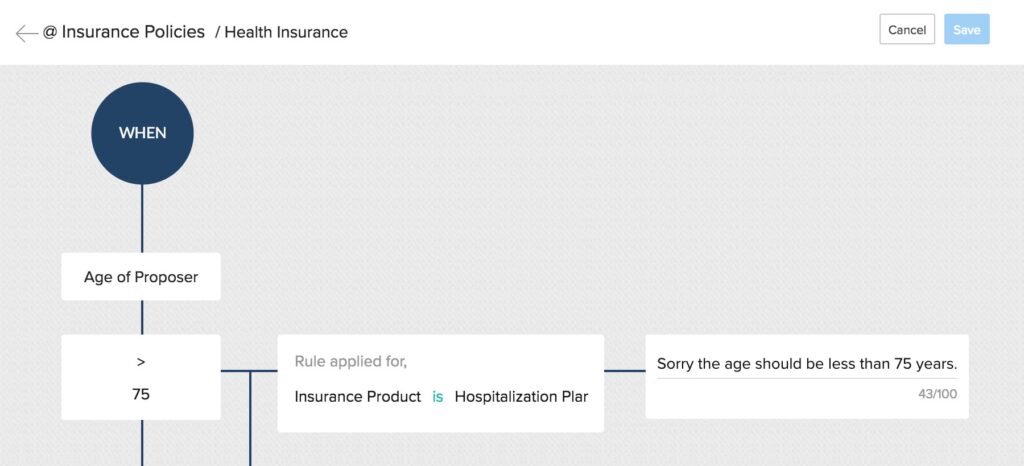

Zoho CRM is an extremely flexible platform best for insurance agencies with needs for affordability and top-class features. With AI-powered intelligence from its Zia assistant, Zoho helps agents forecast sales, identify leads to pursue first, and even trends in customer behavior. The system includes built-in policy reminder, renewal notice, and customer communication automation, reducing the need for repetitive work. Zoho can also perform multichannel communication, allowing agents to communicate with clients via email, phone, chat, and social media using one dashboard. The pricing is competitive and thus something that growing agencies can afford without breaking a bank with enterprise-level functionality. Best suited for mid-sized agencies or brokers who require an all-in-one platform with highly customizable options.

3. Salesforce Financial Services Cloud

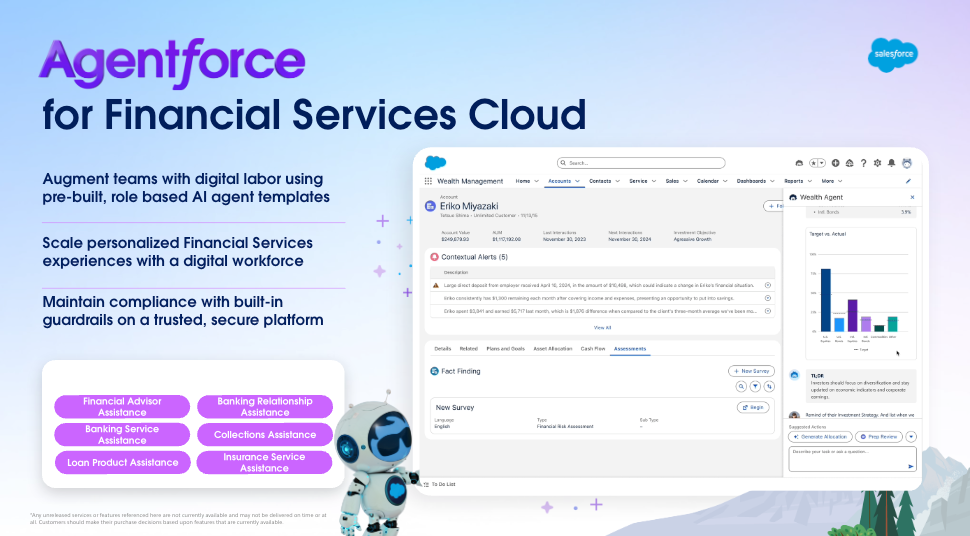

Salesforce is the global leader in CRM, and its Financial Services Cloud is precisely built to serve industries like insurance. It provides a 360-degree view of each policyholder, enabling agents to track relationships, policies, and claims with precision. Its AI tool, Einstein, offers predictive recommendations for cross-selling and upselling insurance policies so that the revenue opportunities are maximized by agents. Salesforce also has advanced tracking of compliance, which is crucial for highly regulated businesses like the insurance industry. Although its price is higher, its robust features, scalability, and industry-specific customization make it the ideal choice for large insurance agencies or companies that desire a robust data-driven CRM.

4. AgencyBloc

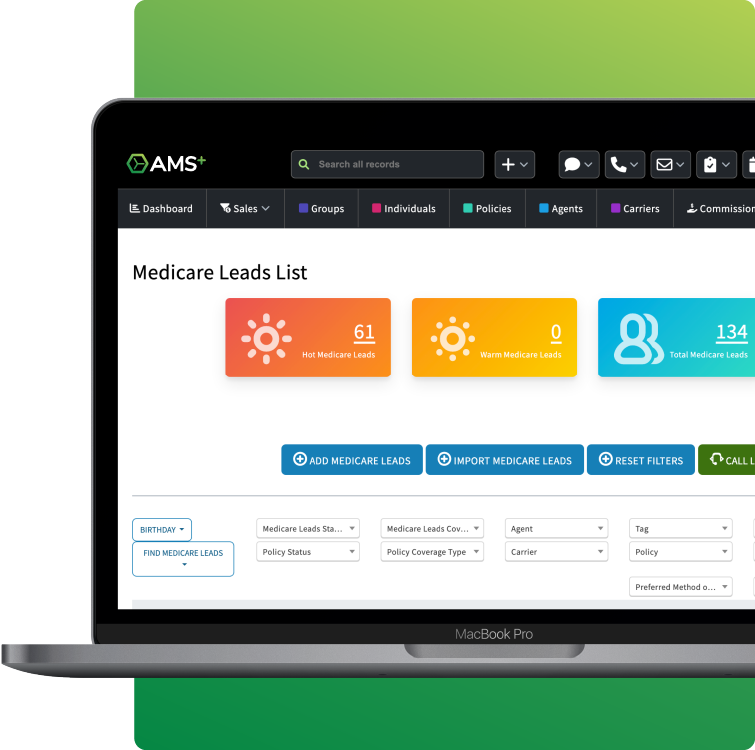

AgencyBloc is a CRM specifically built for life and health insurance agencies, making it one of the highest-rated in niche insurance markets. It offers professional features such as commission tracking, policy management, and workflow reminder automation on a custom insurance lifecycle basis. Agents can store in-depth client and policy data, set renewal reminders, and automate client contact without the need for additional tools. AgencyBloc is unique because it has carrier performance and commission reporting integrated into it, making it possible for agencies to track revenue correctly. The platform’s minimalism makes it easy to implement, and its insurance-focused capabilities mean that it can be utilized straight out of the box. Ideal for life and health insurance agents looking for an industry-focused CRM.

5. Insly

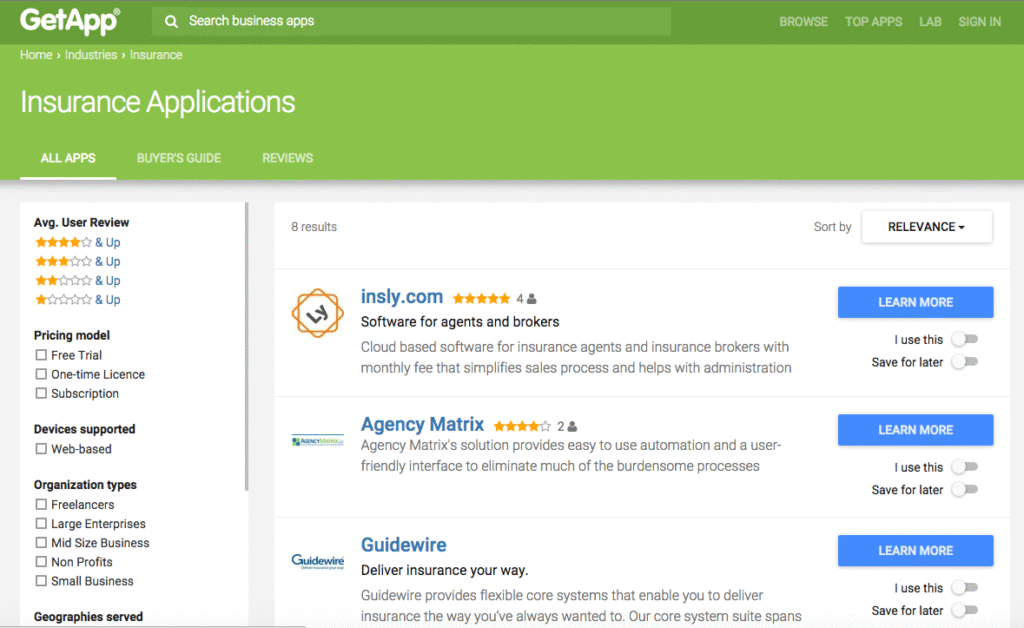

Insly is an insurance broker and agency-friendly cloud-based CRM designed for dealing with complex policies and multiple carriers. It allows agents to issue policies, quote, and service claims from the platform, keeping third-party software needs to an absolute minimum. Insly supports automation features such as client onboarding procedures, document processing, and policy renewals, all of which save valuable time for busy agents. The platform is highly customizable with provision for several lines of insurance such as motor, property, life, and health. With its emphasis on back-office automation and improved customer experiences, Insly is a good fit for agencies that desire an end-to-end solution for sales, administration, and claims. Ideal for agencies with a variety of insurance products and carriers.

How to Select the Best CRM for Your Insurance Agency

Your best choice for a CRM depends on your particular needs:

- Solo Agents: Begin with HubSpot free or Zoho for low-cost automation.

- Growing Agencies: Zoho or AgencyBloc offer the ideal combination of customization and affordability.

- Large Enterprises: Salesforce Financial Services Cloud offers unmatched scalability and compliance functionality.

- Niche Life/Health Agencies: AgencyBloc was designed for you.

- Agencies with Multiple Carriers: Insly is ideal for working with various insurance products.

Quick Link: Best CRM for Small Businesses (2025)

Final Thoughts

Insurance is a business that operates on trust, dependability, and timely service, all of which become difficult to provide without the right technology. An insurance agent CRM ensures that leads are properly developed, policies are tracked, customers are engaged, and revenue potential is maximized. If you are a solo agent just starting out or an agency of several agents serving hundreds of customers, the right CRM can transform your business.

The five solutions we’ve covered, HubSpot, Zoho, Salesforce Financial Services Cloud, AgencyBloc, and Insly, represent the best options in 2025, each with unique strengths tailored to different types of agents and agencies. The choice comes down to your agency’s size, budget, and specialization. Choose wisely, and you’ll not only save time but also deliver the kind of service that keeps clients coming back year after year.

Check out our Digital Marketing Page; for more expert tips and guides.

If you’d like to work in AI and SEO, submit your guest post and Write for Us.

FAQs

What is the best CRM for solo insurance agents?

HubSpot CRM, with automation and its free version, is best for sole agents.

How do I choose the right insurance CRM?

Match CRM to your needs: HubSpot/Zoho for small, Salesforce for big, AgencyBloc/Insly for niche.