In today’s digital world, almost everything we do online leaves behind some kind of data trail. Whether we are shopping, browsing social media, or searching for information, data is collected about our activities. This is where data brokers come into play.

A data broker is a company or individual that collects, processes, and sells personal information about people. These companies gather data from various sources and package it in ways that can be useful for businesses, marketers, or other entities.

In this blog, we will explain what a data broker does, how they collect data, and why this matters for everyday people like you.

What is a Data Broker?

A data broker is a business or entity that collects information about individuals and then sells or shares that information with other companies. The information data brokers gather can include a wide variety of details such as:

- Names

- Addresses

- Phone numbers

- Email addresses

- Social media activity

- Purchase history

- Credit scores

- Health data

- Location data

Data brokers do not typically have direct relationships with the individuals they are collecting data about. Instead, they obtain this information from public records, online activities, apps, and even other companies that share data.

How Do Data Brokers Collect Data?

Data brokers collect information from many different sources. Here are some of the common ways they gather data:

- Public Records: Government databases and public records provide a lot of information. For example, property records, voter registration, and court records can give data brokers access to details like your home address, age, and legal history.

- Online Tracking: Many websites and apps track your online activity. For example, cookies, which are small pieces of data stored on your browser, can track your browsing habits. Data brokers use this information to build profiles about your interests, behaviors, and preferences.

- Purchases: Your purchase history is valuable information. Credit card companies, loyalty programs, and online retailers may sell your transaction data to data brokers. This can include what you buy, where you shop, and how much you spend.

- Social Media: Social media platforms collect a lot of personal information. From your posts to your likes and follows, this data helps build a detailed picture of your interests and lifestyle. Data brokers can use social media data to enhance their profiles of you.

- Mobile Apps: Many mobile apps collect location data, contact lists, and other personal information. Some apps even sell this data to brokers. For example, fitness apps might track your health stats or workout routines, which can then be shared with third parties.

- Third-Party Data Sharing: Many companies share data with each other. For instance, if you sign up for a newsletter, that company may share your information with others for marketing purposes. Data brokers then collect this shared information and add it to their databases.

Related: Google Introduces PIN

What Do Data Brokers Do With the Data?

Once data brokers have collected information, they package it and sell it to other businesses, government agencies, or organizations. The buyers of this data use it for a variety of purposes, including:

- Marketing and Advertising: One of the biggest uses of data broker information is for targeted advertising. Marketers can use detailed consumer profiles to tailor ads to specific audiences. For example, if you often search for vacation destinations, you might start seeing ads for travel deals.

- Credit Reporting: Some data brokers provide information that is used to assess creditworthiness. Lenders may use data from brokers to determine whether or not to approve someone for a loan or credit card.

- Fraud Prevention: Financial institutions and businesses use data from brokers to verify identities and detect potential fraud. This helps reduce the risk of fraud in online transactions and financial services.

- Insurance Underwriting: Insurance companies may use data from brokers to determine the risk profiles of potential clients. This information can influence the cost of premiums for things like health, auto, or home insurance.

- Background Checks: Employers, landlords, and other entities may purchase data to conduct background checks. This could include criminal records, financial history, and even social media activity.

- Political Campaigns: Data brokers sometimes sell information to political campaigns. Campaigns can use this data to target specific groups of voters with tailored messages or advertisements.

Related: Laptop Security

Why Should You Care About Data Brokers?

The idea of companies collecting and selling your personal information without your knowledge or permission can be concerning. Here are some of the reasons why you should care about data brokers:

- Lack of Control: You often don’t know what data is being collected or who has access to it. Data brokers work in the background, making it difficult to control how your information is used.

- Privacy Risks: The more data that is collected about you, the greater the risk of a privacy breach. If a data broker’s system is hacked or the information is misused, sensitive data like your social security number or credit card details could be exposed.

- Inaccurate Information: Data brokers might have incorrect or outdated information about you. This can lead to problems like being denied credit, insurance, or even a job based on inaccurate data.

- Targeted Manipulation: Companies and political campaigns can use data to manipulate your choices. For instance, they can show you ads designed to influence your purchasing decisions or political views based on your personal data.

- Difficulty in Opting Out: While some data brokers allow you to opt out of their databases, the process is often complicated and not all brokers offer this option. Even if you do manage to opt out, your data could still be available through other brokers or sources.

Read also: Sideloading Apps on iOS: Risks & Security Best Practices

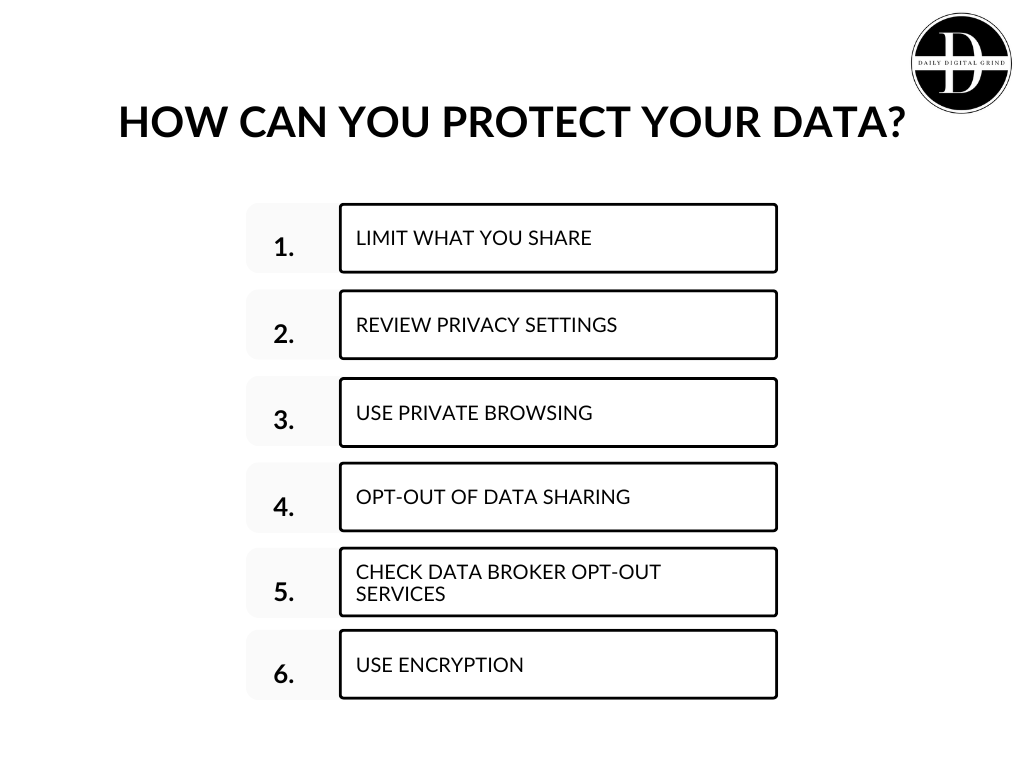

How Can You Protect Your Data?

While it’s difficult to completely avoid data brokers, there are steps you can take to protect your personal information:

- Limit What You Share: Be mindful of the information you share online. Avoid giving out personal details unless absolutely necessary, and be cautious about what you post on social media.

- Review Privacy Settings: Check the privacy settings on your social media accounts, apps, and devices. Set them to the highest level of privacy to limit what data can be collected about you.

- Use Private Browsing: Use private browsing modes or browser extensions that block tracking cookies. This can prevent websites from collecting data about your browsing habits.

- Opt-Out of Data Sharing: Some companies allow you to opt-out of data sharing or tracking. Look for these options when signing up for services, and take advantage of them when available.

- Check Data Broker Opt-Out Services: Several data brokers offer opt-out services. While the process can be time-consuming, it’s worth checking whether you can remove yourself from their databases.

- Use Encryption: Protect sensitive information with encryption, especially when using public Wi-Fi. This can help protect your data from being intercepted.

Conclusion: Understanding Data Brokers and Their Impact

Data brokers play a significant role in the digital economy, collecting and selling personal information that can be used for a wide range of purposes. While their services may offer benefits to businesses and consumers alike, it’s important to understand the potential privacy risks involved.

By taking steps to protect your personal data, you can limit the amount of information data brokers collect about you. However, it’s also important to advocate for stronger regulations and transparency around data collection practices to ensure your privacy is respected in the digital age.

Data brokers may be hard to avoid, but staying informed is the first step in protecting your personal information.

For more tech, security, and marketing insights, visit Daily Digital Grind. If you’re interested in contributing, check out our Write for Us page to submit your guest posts!